GABUNGAN NGO MALAYSIA - GNGOM: SELAMAT DATANG KE SIARAN SULUNG BLOG GABUNGAN NGO ...: SOLIDARITI #916 ADALAH SINONIM TARIKH HARI MALAYSIA PADA 16 SEPTEMBER YANG DISAMBUT SETIAP TAHUN SEJAK PENUBUHAN PERSEKUTUAN MALAYSIA PAD...

MWbmt

MD of Triple Platform S/B, about to have the ‘Finger lickin’ good’ experience

It is final. It was inked during the tail end of the lunar year of the dragon. QSR Brands Bhd. and Johor Corporation Bhd.’s (JCorp) cash-cow KFC Holdings (M) Bhd. have been taken lock, stock and barrel by new SPV Triple Platform Sdn. Bhd. (TPSB) and now a private company. It was announced part of the restructuring plan and the ‘new KFC’ (probably still using the company name QSR), TPSB would be relisted in Bursa Malaysia within the next four years.

Triple Platform to be relisted

Triple Platform Sdn Bhd, the temporary holding company for KFC Holdings (M) Bhd and QSR Brands Bhd, will be relisted onBursa Malaysia in another four to five years after its privatisation, Managing Director Datuk Ahmad Zaki Zahid said.He said the company, which was delisted today, would restructure the whole management by consolidating KFC Holdings (M) Bhd and QSR Brands Bhd into one management.“Right now, we are attempting to name our company QSR. But that is subject to approval,” he said at the launch of KFC’s 58th Projek Penyanyang and Pizza Hut’s Nationwide Delivery.Ahmad Zaki, who thanked the shareholders for their support, said a new board of directors would be announced by the third week of February.He is confident that with the merging of two brands under one roof, the companies would work together and focus on improving their revenues and benefitting their shareholders.On outlook, Triple Platform hopes to achieve nine to 10 per cent increase in revenue to RM4 billion in 2013, from last year’s RM3.6 billion.In order to achieve its target, the company has allocated RM170 million this year to renovate and refurbish its KFC and Pizza Hut outlets.At present, Triple Platform has more than 1,000 KFC and Pizza Hut outlets nationwide and in other countries such as Singapore, Brunei, Cambodia and India.Today’s event was held in conjunction with Chinese New Year celebration, where orphans and the elderly from five homes were invited. — Bernama*******************

The deal is for RM 2.465 billion and the terms is cash. Triple Platform Sdn. Bhd. (TPSB) raised the cash for the outright acquisition.

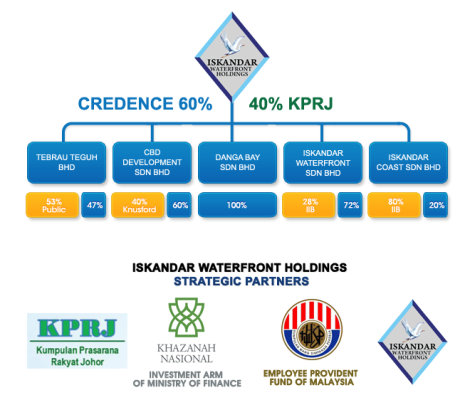

TPSB is wholly owned by Massive Equity Sdn. Bhd. (MESB). 51% of MESB is owned Business Chronicles Sdn. Bhd. (BCSB), where the shareholders are JCorp and IWH Resources Sdn. Bhd. (IWHR). IWHR is a wholly owned company by Iskandar Waterfront Holdings Sdn. Bhd. (IWH), a joint venture between Kumpulan Prasarana Rakyat Johor (KPRJ) and Credence Resources Sdn. Bhd. (CRSB), a company controlled by notable contractor-turned-developer Tan Sri Lim Kang Hoo.

The other 49% portion of MESB is own Melati Ehsan Sdn. Bhd. (MESB II). The shareholders of MESB II are EPF (52%) and UK based venture capitalists CVC Capital Partners Ltd. (48%). CVC has representatives in Singapore.

It is also interesting to note that Johor State Government injected RM 50 million of Tabung Warisan Johor into this TPSB structure. The fund was created when Deputy Prime Minister Tan Sri Muhyiddin Mohd. Yassin was still the Menteri Besar Johor and the purpose is to maintain and preserve various heritage buildings and sites all over Johor. This investment in TPSB will ensure that fund is invested in a productive cycle.

BCSB raised RM 1.265 billion where else MESB raised the balance RM 1.2 billion. It was part of the the RM 5.12 billion deal for the acquisition of QSR Brands Bhd. and KFC Holdings (M) Bhd. and the restructured vehicle be taken private. Earlier this month, the delisting from Bursa Malaysia is made final.

What is interesting note is the deals that were layered to make this TPSB deal happened. JCorp entered into a ‘Subscription Agreement’ with IWHR and IWH for the injection of funds into BCSB. Since IWH raised the cash from syariah compliant instruments, the commercial papers are backed with an agreement with JCorp as the partner in BCSB.

The deal is that since JCorp is controlling the management of TPSB, they are expected to list the SPV company within four years. The commercial papers have a coupon value of 12% and maximum of 20%. The stake for the deal is RM 600 million worth of ‘pre-determined properties’ of JCorp, as a ‘safety catch’ for the stakeholders of BCSB if TFSB is not listed as planned within four years.

The stake is very palatable to corporate playmakers, considering JCorp owns prized properties around central Johor Bahru such as Menara Ansar, Puteri Pacific, Persada Convention and KOMTAR. Also at stake is believed to be Pusat Bandar Damansara.

That is not a surprise since the controlling personality of IWH is Tan Sri Lim Kang Hoo, via CRSB. Lim is already the ‘Property King’ in Greater Johor Bahru and he made no qualms about talking aloud of his grand plan to take southern-most city in mainland continent Asia into various mega project business deals. Lim enjoys a strong nod from Johor State Government via KPRJ, Federal Government, via Iskandar Region Development Authority (IRDA) and Khazanah Holdings Bhd., via Iskandar Investment Bhd.

Lim is also a personality who gets the attention if not support of HRH Sultan of Johor and Prime Minister Dato’ Seri Mohd. Najib Tun Razak.

These layered deals could not be the brainchild of Lim on his own, even though he is seasoned corporate player. It is a series of restructuring corporate manuevres and sophisticated merchant banking deals, pieced by experienced corporate players. It is almost like the handiwork of ‘Level Four Boys’.

Dato’ Ahmad Zaki Zahid has been placed right in the middle of JCorp Group and with executive power, especially within Kulim Bhd. Kulim is the parents company of QSR and KFC. Zaki was PM ‘Flip-Flop’ Abdullah Ahmad Badawi’s Chief Policy Officer and was instrumental in many of the ‘Level Four Boys’ corporate maneuvers. Iskandar Malaysia (then Iskandar Development Region) was an economic corridor created by Zaki and his cohorts of ‘Level Four Boys’ agents.

Khazanah’s ‘chief architect’ for Iskandar Malaysia Ganen Sarvananthan

Probably Ganen Sarvananthan is also in this picture. Ganen, who has been in Khazanah since the days of ‘Level Four Boys’ reign supreme is Khazanah’s ‘corporate maneuvres architect and master planner’. These ‘Level Four Boys’ combined network especially in the financial and capital market is very much strong across the Johor Straits.

These ‘Level Four Boys’ probably pieced the layered agreements together and utilised Lim’s vehicle for the deal. It is a good cover since Lim is a trusted corporate player in Greater Johor Bahru and Prime Minister Najib’s endorsement for all the projects being developed falls into slots of the latter’s economic transformation programs. Lim’s clout would mean that the dealmakers would make a clean home run with their corporate deals.

On the other hand, only personalities like ‘Level Four Boys’ could piece a layered agreement where a party which pumps in RM 250 million cash, which effectively is just a mere 10% of the cash raised, stand to gain having the controlling power of RM 600 million worth of ‘pre-determined properties’ if the deal did not come through as planned.

It is interesting to note that JCorp’s restructuring plan (which include this one) is being advised by JP Morgan. It is unclear why a foreign investment bank is sought for the restructuring exercise instead of local investment banks but all the guesses would easily point to the same direction. JP Morgan fee for the JCorp job has been rumoured to be RM 60 million. That is 25% of TPSB’s 2013 projected profit before tax.

Then again having local investment bankers as advisers (such as the FGV IPO late 2011 and early 2012) means that probability of ‘hanky panky’ via layered deals unseen into the public’s radar scope, is very much reduced.

Wan Ahmad Firdaus Wan Ahmad Fuaad

Another personality which was appointed into Kulim (M) Bhd. BOD the same time as Zaki is Wan Ahmad Firdaus Wan Ahmad Fuaad has left JCorp. It has been rumoured that he had joined JP Morgan. If it is true, then there are serious conflict of interest in this restructuring job. JCorp also appointed Eddie Leung into Kulim BOD, the same day as Zaki and Wan Firdaus.

Let us put the caveat of where KFC is going and what is at stake. It is all and well that Zaki as the new MD for TPSB announced that KFC and Pizza Hut would be transformed and new outlets around the region would be added. New business activities such as upstream food production and farming would be introduced and he intends to increase the turnover of the group by 10% and achieve the RM 4 billion mark.

Steady growth and maintaining good profitability would seal the deal for TPSB be re-listed again in Bursa Malaysia within the next four years.

However, what if TPSB fail to do so. Especially due unforeseeable phenomenons such as volatile weather (El Nino and El Nina), haze due to jungle burning around the region and diseases (SARS and Bird Flu). Upstream food production especially farming is very elastic to these elements.

JCorp’s structure when Zaki, Wan Firdaus, Eddie Leung and Natasha were brought in

It was argued in the past that JCorp is unhappy for a long time with its stake in KFC is via QSR and Kulim. JCorp is the ultimate shareholder of the lucrative fast-food businesses of QSR and KFC. Its interests in both the companies are held through its 53%-owned subsidiary Kulim (M) Bhd, whose main business is in the plantation sector. Kulim owns a 57.5% stake in QSR, which in turn, owns a 50.6% stake in KFC.

Not only JCorp does not enjoy the profitability of KFC via layered stakeholders, the journey is not without several notable boardroom tussles. The pressing need to restructure the RM 6 billion group financial commitments and exposures and KFC being the most profitable and solid cash-cow in the JCorp, has been exploited as the opportunity presented itself.

It is true after this JCorp’s interest in TPSB is via a thinner layer than it was before. In fact, JCorp could enjoy the better returns. However, it is interesting to also note that even though JCorp’s holding is the single largest after the restructuring, the effective interest in TPSB is only 26.8%. Johor State Government’s interest via KPRJ is 8.9%. The combined two (Johor’s stake) is 35.7%.

The Non Bumiputra stake in TPSB is reflected with CRSB (15.2%) and CVC (23.5%).

Iskandar Waterfront Holdings Sdn. Bhd., which Lim Kang Hoo plans to list in not to distant in the future

The forfeiture of the RM 600 ‘pre-determined properties’ if salient points within the subscription agreement of BCSB means that Johor State Government’s stake (via KRPJ) is preserved in IWH. However it is hardly ‘From left pocket into the right pocket’ since KPRJ is not the controlling shareholder in IWH and Johor’s interest would be at the behest of Lim.

It is hardly a mystery on JCorp’s offer to IWH for the partnership stake of BCSB instead of entities which will benefit the Bumiputra interests such as PNB, Tabung Haji or FGV. Tabung Haji and FGV are very much into upstream food production activities. Then again, these ‘Level Four’ individuals would have limited space and opportunity to do ‘corporate maneuvres’ via these highly regulated GLCs.

People are often reminded to let bygones be bygones and move on. However, this noble virtue should not apply to the ‘Level Four Boys’. Whenever they have a whiff of power, they would exploit it at the expense of the bigger majority. The deal was inked in the lunar year of the black water dragon. Then again, the water snake is a very lethal animal. Especially, when snakes with previous killings still roam free as predators.

It is unclear how these ‘Level Four’ individuals benefitted from the Triple Platform deal. However, what is certain some people are enjoying their new found prize and lickin’ their fingers (and God forbids, eventually someone else’s fingers too), really good.